Encountering a disagreement with your insurance company can be a frustrating experience. But, by following a methodical approach, you can increase your chances of achieving a favorable outcome. Initiate by carefully scrutinizing your policy documents to understand your coverage. Record all communication with the insurance company, including dates, times, and names of individuals you speak with. If you are unable to mediate the dispute amicably, evaluate pursuing legal representation. A qualified attorney can direct you through the formal process and represent on your behalf.

- Maintain detailed records of all relevant information, including communication, invoices, as well as any other supporting documents.

- Understand your policy's terms and provisions to determine your rights.

- Interact with the insurance company in a professional and polite manner.

Winning Your Insurance Claim: Strategies for Success

Securing a successful payment from your insurance claim can feel like navigating a labyrinth. Don't stress! By following these key approaches, you can maximize your chances of a positive finish. First and foremost, carefully review your policy documents. Familiarize yourself with the provisions regarding your coverage limits and the system for filing a claim. Swiftly report any incident to your insurance copyright, providing them with accurate information about the situation.

Keep detailed records of all correspondence with your insurer, including dates, times, and parties involved. Photograph any damage or injuries pertinent to your claim. This evidence will be crucial in proving your case.

Consider consulting to an experienced insurance advocate. They can assist you through the process, negotiate your best interests, and help confirm a fair settlement. Remember, being persistent and knowledgeable is essential for securing a successful insurance claim.

Don't Get Denied

Dealing with an insurance company that's pushing back can be incredibly frustrating. But don't let them win! You have leverage and there are steps you can take to get the coverage you deserve.

First, make sure your documentation is read more impeccable. Collect all relevant information and send them in a timely manner. If your first appeal is denied, don't lose hope. Carefully review the justification for the denial and see if there are any omissions you can address.

Then, consider appealing the decision. You may want to speak with from an insurance lawyer who can help you navigate the procedure. Remember, persistence and preparedness are key to succeeding insurance company pushback.

Understanding Your Policy and Rights in an Insurance Dispute

Navigating an insurance dispute can be a complex process. It's crucial to completely review your policy documents to comprehend the terms, conditions, and coverage limits that apply to your situation.

Your policy will outline the detailed circumstances under which your insurer is duty-bound to provide coverage. It's also important to become yourself with your legal privileges as an insured party. These rights may include the ability to challenge a rejection of coverage or seek a formal review of your claim.

If you encounter difficulties understanding your policy or believe your rights have been infringed, it's advisable to speak with an experienced insurance broker. They can assist you in analyzing your policy language and explore available alternatives to settle the dispute.

Resolving Issues with Your Insurer

When arguments arise with your insurance provider, clear and concise communication is paramount. Start by carefully reviewing your policy documents to understand your coverage and any relevant exclusions. Log all interactions with the insurance company, including dates, times, names of representatives, and notes. When contacting the provider, remain collected and respectful. Clearly state your concerns in a logical manner, providing supporting evidence whenever. Be tenacious in pursuing a fair resolution. If you encounter difficulty settling the issue directly with the provider, consider submitting your case to their customer service department or an independent insurance ombudsman.

Typical Insurance Claim Pitfalls and How to Avoid Them

Filing an insurance claim can be a complex process, and navigating it successfully requires careful attention to detail. There are several common pitfalls that claimants often run into, which can lead to delays or even denials. To ensure a smooth claims process, it's essential to be aware of these potential problems and take steps to avoid them.

One frequent mistake is submitting an incomplete application. Be sure to furnish all the necessary information and documentation, as missing details can result in your claim being suspended. It's also crucial to notify your insurer about any changes to your situation promptly. Failure to do so could void your coverage and leave you unprotected in case of a future occurrence.

Another common pitfall is inflating the extent of your losses. While it's understandable to want to receive full compensation, being dishonest about damages can cause serious ramifications. Your insurer has ways to confirm claims, and any discrepancies will likely lead to a denied claim or even legal action.

Remember, honesty and transparency are key when dealing with insurance claims. By avoiding these common pitfalls and following best practices, you can increase your chances of a favorable outcome.

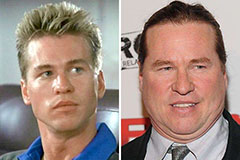

Val Kilmer Then & Now!

Val Kilmer Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!